Overview: It looks like all markets are sensing that a new wave of liquidity is about to be released. Gold, stocks, and crypto are edging higher. Notably, even bonds, which have been mired in a bear market, have experienced a rally.

General Remarks:

In this post, I extensively elaborate on the rationale behind employing two alternative definitions to evaluate secondary reactions.

TLT refers to the iShares 20+ Year Treasury Bond ETF. You can find more information about it here

IEF refers to the iShares 7-10 Year Treasury Bond ETF. You can find more information about it here.

TLT tracks longer-term US bonds, while IEF tracks intermediate-term US bonds. A bull market in bonds signifies lower interest rates, whereas a bear market in bonds indicates higher interest rates.

A) Market situation if one appraises secondary reactions not bound by the three weeks and 1/3 retracement dogma

As I explained in this post, the trend was signaled as bearish on 12/18/24.

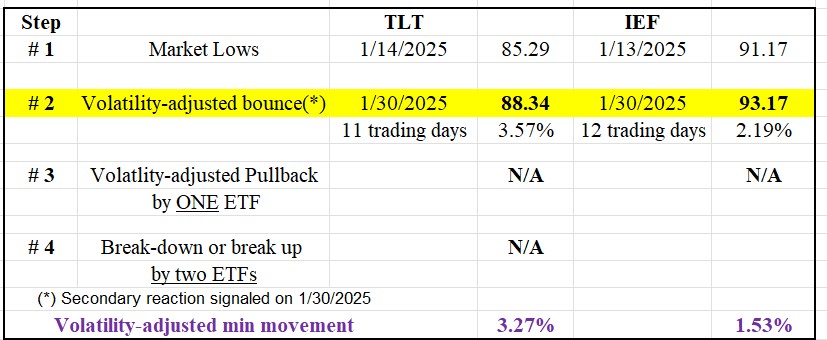

The drop continued until IEF made its last closing lows on 1/13/25 (at 91.17) and TLT on 1/14/25 (at 85.29).

Following such lows a rally ensued. On 1/30/25, the rally met the time requirement for a secondary reaction. The rally also exceeded the Volatility-Adjusted Minimum Movement (VAMM, more about it here), so the extent requirement for a secondary reaction was also met.

The Table below shows all the information you need:

Now, we are waiting for a >=2 pullback that exceeds the VAMM in at least one ETF to complete the setup for a potential primary bear market signal. We must wait.

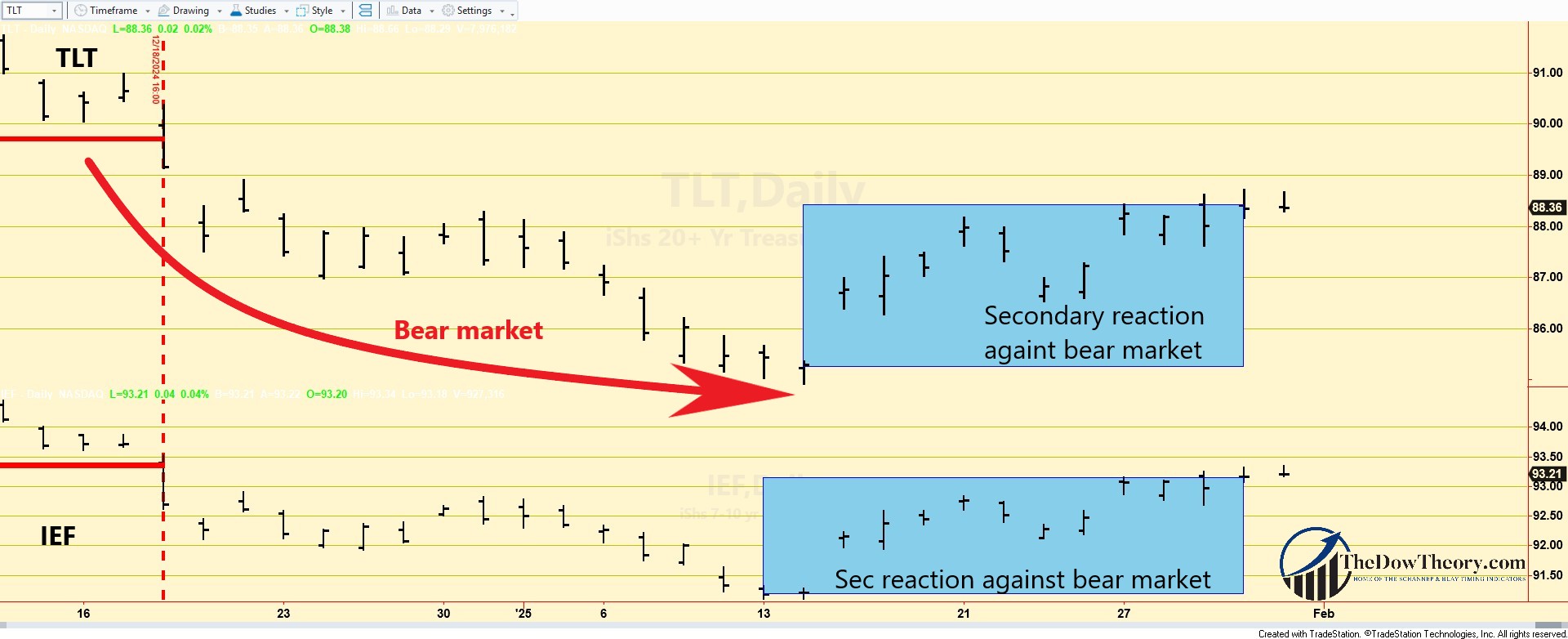

The following charts depict the latest price movements. The blue rectangles display the secondary (bullish) reaction against the still-existing bear market.

Therefore, the primary trend is bearish, and the secondary one is bullish.

B) Market situation if one sticks to the traditional interpretation demanding more than three weeks and 1/3 confirmed retracement to declare a secondary reaction.

As I explained in this post, the trend was signaled as bearish on 12/18/24.

The current rally has not met the time requirement for a secondary reaction. So, the rally must continue higher to reach at least 15 trading days by both TLT and IEF.

Therefore, the primary and secondary trends are bearish.

Sincerely,

Manuel Blay

Editor of thedowtheory.com